Mint

Mint.com is one of the best free money

management websites out there. It is as simple and as feature rich as it

gets. It can directly connect with your bank accounts, credit card

accounts, investment accounts, etc. and get all the details from there.

So, whenever you open Mint, you will be able to see all the transactions

of those accounts. In addition to that, it will also tell you about

upcoming bills of those accounts. One of my favorite feature is that if

there is any fee charged to any of your account, it will alert you via

email, so that you can review that fee, and take necessary action.

Coming back to transactions, it not only shows all the transactions, but

also neatly categorizes them. You also have option to overwrite a

category, and put all similar transactions together. And it keeps

evaluating your accounts constantly to give you intelligent money saving

suggestion (for example, it might tell you to start a CD with a

particular bank to get some interest on the money that is lying

uselessly in your account, or change your credit card to some other bank

that might give you a lower interest rate). In all, if you are one of

those who always want to manage the money, but never really do, this is

really the best solution out there. It will do everything for you, and

will not ask you to manually log your transactions.

Click Here to go to Home Page

PowerWallet

PowerWallet

is another free money management website that helps you manage and

track your income, expenses, bank accounts, cash flow, investments, and

budgeting. It provides a platform with advanced tools for managing and

viewing your personal finances in one location. The platform is

convenient and secure for setting budgets and monitoring expenses.

Create a new budget and analyze your cash flow for both income and

expenses. The calendar reminds you of upcoming payments and displays

your daily activities. For data security, it provides encryption tool

and doesn’t store any data unsafe. It has tons of useful features such

as:

- Alerts and Reminders.

- 256-bit SSL encryption.

- Monitor cash flow in real-time.

- Categorize different transactions.

- Link real accounts or customize accounts as required, and much more.

Click Here to go to Home Page

Personal Capital

Personal Capital

is a free money management website which tracks and synchronizes all

your financial accounts in one place. It creates brief statement of your

net worth, cash flow (income/expenses), and investment portfolio. It

has an investment checkup tool, which comes with high level

recommendations for asset allocation. You can use budgeting tools to

track and analyze your weekly, monthly, and yearly income or expenses.

It also displays your due dates and upcoming bills to avoid late fees.

You can monitor and generate charts or graphs for income, expenses, and

other portfolio. It also has an application for iPad, iPhone, and

Android Smartphone for tracking your finances on the go. It offers some

excellent features:

- Uses 256-bit SSL encryption.

- Investment checkup.

- Retirement planner and fee calculator.

- Email notifications for account details, and much more.

Click Here to go to Home Page

Buxfer

Buxfer

is another free money management website that helps you monitor and

track all your financial accounts in one location. The summary tab

displays your net balance, budgets, and recent spending for each

account. You can also view charts and detailed information about budgets

and expenses using summary tab. It lets you create bill reminders, add

categorized budgets, tag budgets, organize loans, and much more. You can

generate and categorize reports or pie charts with entities like food,

utility, leisure, rent, etc. Provide your account’s username and

password to automatically download and update transactions. Buxfer has a

unique option that report transactions via SMS through Twitter. It

allows you to make payments and receive payments online using PayPal. It

comes with free as well as paid versions:

Free Version:

- Add unlimited transactions.

- Basic reports and shared bills, etc.

Paid Versions:

- Add unlimited accounts, budgets, and bill reminders.

- Advanced reports, backups, and cash flow forecast, etc.

Click Here to go to Home Page

Yodlee Labs

Yodlee Labs is a free to use money

management website, which can be used to manage and control all your

finances. The dashboard displays expenses chart, net worth, payments,

alerts/reminders, and financial transactions. You can add multiple

accounts with categories like banks, credit card, real-estate,

investments, etc. Set budget goals for categories like income, expenses,

or transfers and get alerts for each transaction. It lets you share

your accounts information to others for collaboration, and

communication. Using expense analysis you can generate pie chart and

tabular report for your spending. It also has apps for iPhone/iPad and

Android, but comes with a price of $3.99. Yodlee Labs offer some

excellent features, like:

- Generates various reports, graphs, and charts.

- Pay bills online and set up recurring transactions.

- Data security with 256-bit encryption.

- Various alerts and reminders, and much more.

Click Here to go to Home Page

Mvelopes

Mvelopes

is another web-based money management application that uses digital

envelopes to analyze your budget and cash-flow (income/expenses). You

can track and get a real-time view of all your accounts and

transactions. It automatically synchronizes and downloads the

transactions for all your accounts. You can create multiple budget

envelopes by assigning different categories such as groceries, rent,

utilities, etc. It allows you to define and personalize your own rules

for alerts and notifications. You can also set goals for savings with

entities like retirement, and emergency fund. Mvelopes uses 256-bit SSL

encryption to secure your data for online bank accounts. The iPhone and

Android applications can be used to monitor your money on the go.

Mvelopes offers free and paid editions:

Free Edition:

- 4 bank accounts with 25 spending envelopes.

- Tagging and cash flow reports.

- Email support, and much more.

Paid Editions:

- Unlimited bank accounts with unlimited spending envelopes.

- Integrated video content and debt roll-down.

- Email and live chat support, etc.

Click Here to go to Home Page

BudgetSimple

BudgetSimple is a free online budget

management website which monitors your spending with respect to

earnings. At first, choose your primary financial goal with options like

Eliminate Debt, Manage My Money, Building Savings, Spend Less, and

Other. Create new budgets by entering your income and expenses. It

displays tabular representation of different expense categories with

fields like “Budgeted Amount” and “Actual Spent”. Using debt payoff

tool, you can add your credit cards and other debts for monitoring.

Saving funds tool can be used to manage your periodic expenses and

tracking your saving goals. It lets you add your extra income and

expenses using budget new expense, and budget new income buttons. It

offers two different plans:

Basic Free:

- Necessary tools for managing budgets.

- Various reports and graphs, and much more.

Plus Edition:

- Mobile apps.

- Link your bank accounts.

- Ads free interface, etc.

Click Here to go to Home Page

BudgetPulse

BudgetPulse is

another money management website that keeps track of your income,

expenses, and budgets. The dashboard lets you monitor and manage your

budgets by displaying cash flow, net worth, budget status, etc. You can

add multiple accounts with categories like checking account, credit

card, saving, assets, and liabilities. It lets you create different

charts and graphs to visualize and analyze your finances. You can import

QIF, QFX, or OFX files and export reports/graphs as PDF files.

BudgetPulse doesn’t connect with your bank accounts, so either you have

to download transactions or enter them manually. Online fundraising tool

can be used to collect money from your colleagues, friends, or family

through PayPal or Amazon. It offers various features, such as:

- Add recurring transactions.

- Add and share goals.

- Direct download from bank websites, and much more.

Click Here to go to Home Page

Budget Planner by MoneySmart

Budget Planner

is a free online personal budget manager by MoneySmart that analyzes

your finances. You can track and monitor your income and expenses as

well as figure out the possibilities to save money. You can either

import previously saved budget or create a new budget with different

categories. The categories included are income, home/utilities,

insurance/financial, groceries, personal/medical, entertainment/eat-out,

and transport/auto. You can login to save your budget sheet online, or

you can view using Word and save it to the computer without login. The

summary tab displays your cash flow by analyzing your expenses with

respect to income. It comes with features, like:

- Simple and efficient.

- Visualize cash flow (income/expenses).

- Nominate payment frequency.

- Save budgets online and print it directly, and much more.

Click Here to go to Home Page

MoneyStrands

MoneyStrands

is a free money management website that lets you create new budgets and

control your expenses to reduce unnecessary spending. You can analyze

your finances and generate various reports (charts/graphs). It provides

up-to-date pie charts and graphs that display detailed reports of your

finances. It lets you share your financial information and connect with

others for collaborative money management. The bill tracker helps you

track your recurring bills, upcoming bills, paid bills, amount due,

payee information, etc. The new budgeting wizard lets you create a 12

month spending plan and is completely customizable. You can either link

your bank accounts or create a manual account to track your income and

expenses. It automatically downloads and import transactions from your

bank account, credit card account, etc. It also has apps for iPhone and

iPad to help you manage your money on the go. Some of the features of

MoneyStrands are:

- Supports multiple languages and currencies.

- Export files as CSV, OFX, etc.

- Supports reconciliation of bank accounts.

- Web and email alerts.

- Categorize budgets, split transactions, etc.

Click Here to go to Home Page

InEx

InEx

is another full-featured budgeting and money management website which

helps you manage your personal finances efficiently. You can record and

track transactions using various currencies such as Dollar, Euro, Pound,

Rupees, etc. It lets you create multiple accounts and budgets with

different categories, personalized tags, monthly budgets, etc. Generate

wide range of reports and graphs to track and analyze your income,

expenses, and budgets. It has a rollover budget option which takes your

available balances to the next month. InEx lets you manage your debts

and deposits, monitor payments and installments, etc. It lets you create

short and long term financial goals, in order to increase savings as

well as to track your progress over time. You can download and import

CSV, OFX, and QIF files directly from the bank account. To get access,

simply sign-up or use your Facebook, Google +, and Twitter credentials

to login. It exhibits some essential features, such as:

- Online budget planner.

- Online calendar and transactions scheduler.

- Alerts and email notifications for account activities.

- Schedule recurring payments.

- Create backup or export data as CSV files.

- Customizable charts and graphs, and much more.

Click Here to go to Home Page

MoneyTrackin

MoneyTrackin is

a free web-based personal finance management application that helps you

track all your income and expenses with ease. It is also an excellent

application for budget management that allows clear view of your income

and spending. You can create unlimited number of accounts with different

currencies available such as Dollar, INR, Pound, Yen, etc. It lets you

share your account information with others for collaboration and working

together. You can tag your income or expenses with entities like

entertainment, utilities, food, rent, etc. Add recurring transactions or

periodic transactions like insurance, installments, etc. and it will

get automatically updated for every month. In order to eliminate

unnecessary spending and budgeting control, you can assign monthly

limits to any tags or accounts. Generate various charts and graphs for

visual interpretation of your financial health. MoneyTrackin offers

various features, like:

- Fund transfer between accounts.

- Community tips for money management.

- Real-time dashboard.

- Schedule different transactions, etc.

Click Here to go to Home Page

JustBudget

JustBudget is

another free web-based application which helps you by managing your

personal budgets. You can create unlimited budgets with multiple

currencies and for different households, investments, sub-companies,

etc. JustBudget lets you enter your spending on a day-to-day basis and

generate accurate stats with graphical and tabular representations. The

dashboard shows a tabular representation of your earnings, expenses,

balance, spent percentage, and popular locations/categories. It also

displays graphical representation of your savings, earnings/expenses

total, and earnings/expenses count statistics. You can add multiple

transactions and recurring transactions which occur repeatedly in a

particular time period. Enter transactions manually or import bank

statements as OFX, QFX, QBO, and ASO files. The listing expenses feature

provides you an overall list of expenses, income, all transactions, and

recurring expenses.

Click Here to go to Home Page

ExpenseView

ExpenseView is

a free online expense tracker which lets you know your expenses as per

your income. The interface is simple and has tabs like home, expense,

income, and balance. The expense and income tabs let you add

income/expenses, edit income/expense categories, search or export

income/expenses, and view breakdown and trends of your income/expenses

with graphs. You can also add expenses using mobile web application or

Google gadget easily. The balance tab can be used to view and compare

balance changes for income and expenses respectively. It allows you to

import bank/credit card statements as OFX and QFX files, and then

specify the description and categories for each transaction. ExpenseView

lets you create or update recurring income or expense transactions by

entering fields like category, amount, start/end date, etc. Ultimately,

the features offered are:

- Personalize categories for income or expenses.

- Overall view of income and expenses.

- Add recurring transactions, etc.

Click Here to go to Home Page

TrackEveryCoin

TrackEveryCoin is

another best free money management website using which you can track

your income, reimbursements, expenses, savings, etc. It also lets you

split your bill payments with your friends and set up reminders for bill

dues. The dashboard shows various graphs for income vs. expenses,

expenses vs. savings, and expenses vs. budgets respectively. On the top

of the application interface, it has a bar which displays your income,

net savings, budgets, and expenses constantly. You can add transactions

by yourself or upload statements from your PC and modify them.

TrackEveryCoin also provides options where you can track money you owe

to others or vice versa. Add several events which will work as a

reminder and you can also add contacts using my address book option.

Other features are:

- Mobile application.

- Track receipts or pay slips.

- Download income and expenses reports as PDF files, and much more.

Click Here to go to Home Page

BudgetUp

BudgetUp is

a free budget management website that helps you track your cash flow

(income/expenses). You can either link your bank accounts or create

manual accounts and add transactions or import them from your PC. It

lets you manage multiple accounts such as current accounts, prepaid

cards, credit cards, wallet, cash, PayPal, etc. in one location. Add

multiple tasks from your Twitter account directly and export detailed

reports as CSV files. You can analyze your monthly statements and

generate reports with entities like future sales, expenses, operations,

cash flow, etc. Create tags or group of tags to label and categorize

transactions in order to generate monthly and annual reports. BudgetUp

displays detailed cash flow of your revenues and expenditures. BudgetUp

is simple but efficient, it uses SSL to encrypt you account info and

data details, and much more.

Click Here to go to Home Page

Controle.Finance

Controle.Finance is

a free online personal finance manager that lets you track your income,

expenses, loans, and investments. You can create multiple budgets and

goals to monitor your financial status and investment status.

Controle.Finance lets you add various accounts and transactions with

different currencies available such as Dollar, INR, Pound, Yen, etc. Add

transactions manually or import transaction statements as XLS/XLSX,

OFX, QIF, and CSV files. To keep your data secure and safe,

Controle.Finance uses 128-bit encryption, daily backups, and much more.

You can generate various reports with entities like statement summary,

budget report, net worth, income vs. expenses, etc. The pin board acts

as a sticky note, where you can write down anything, like bill payments,

upcoming dues, shopping list, etc. Some important features are:

- Unlimited numbers of accounts and transactions.

- Create unlimited categories and sub-categories.

- Export transactions and reports as PDF, CSV, XML, and XLS/XLSX files.

- Multiple currencies and view exchange rates, etc.

Click Here to go to Home Page

Pibi

Pibi

is a simple and easy to use online money management application which

helps you track your day-to-day finances. You can create multiple

accounts and analyze your income, expenses, budgets, and recurring

transactions. It lets you work offline and then synchronize all your

data to the cloud when online. Pibi lets you add tags to the

transactions and to customize the payments options as needed. For any

account or transaction, you can choose multiple currencies and view

exchange rates accordingly. You can set up budgets for monitoring

finances to see where your money is going and where it can be saved. Use

Pibi from your mobile phone or tablet and they will automatically

synchronize with Pibi cloud. Pibi offers the following features:

- Customizable interface.

- Manage finances offline.

- Supports recurring transactions.

- Add tags, and much more.

Click Here to go to Home Page

ClearCheckBook

ClearCheckbook is

another free finance management website that helps balancing your

checkbook, tracking your expenses, analyzing your budget, etc. You can

add numbers of transactions to an account by assigning different

categories. Create new budgets and set spending limits to monitor your

expenses with respect to revenues. It lets you mark any transaction as

jived (cleared/balanced) which indicates that the transaction has been

cleared or balanced. The dashboard gives a quick glance of your finances

and lets you add transactions, view reports, monitor budgets, check

balances, and much more. You can generate reports for various accounts

and categories as pie charts, line charts, bar charts, and text based

reports. It allows you to schedule transactions and set up email

reminder for due dates, bill payments, etc. The bill tracker manages all

your bills and alerts you for bills due, upcoming bills, bill payment

progress, etc. It also has apps for iPhone/iPad, Android, and Windows

phones that sync data with your online accounts. ClearCheckbook offers

free and paid versions with features, like:

Free Version:

- Split transactions.

- Customized dashboard.

- Register checkbooks (Jive).

- Add recurring transactions, and much more.

Paid Version:

- Running balances.

- Automatic backups to Dropbox.

- Transaction histories up to 12 months.

- Multiple users per account, etc.

Click Here to go to Home Page

PocketSmith

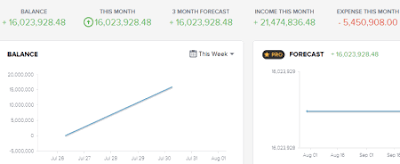

PocketSmith is

a comprehensive online finance manager that forecasts your daily bank

balances and overall cash flow. The calendar lets you schedule budgets

and upcoming payments to analyze your financial health. You can either

connect your bank account or enter manual account information with

different categories. The main feature of PocketSmith is financial

forecasts, using which you can enter your income and expenses on a

calendar and view your daily balances at a glance. You can create

multiple scenarios for each account and test decisions like buying a

house, home decorations, planning a wedding, etc. Add transactions using

file upload or manual entry and categorize them with pre-defined

templates or create your new category template. You can generate

interactive reports for your finances as pie charts, line charts, and

bar charts. It lets you set up financial goals with entities like future

expenses, emergency funds, savings, and much more. PocketSmith has two

different plans:

Free Plan:

- Provides 2 accounts, 2 calendars, and 12 budgets.

- 6 months projection and 3 months history.

- No automatic download from bank accounts.

- Import OFX, QFX, QIF, and CSV files, etc.

Paid Plans:

- Live bank feeds with automatic update.

- Unlimited budgets and calendars.

- 10-30 years projection and 10-unlimited accounts.

- Automatic download from bank accounts, etc.

Click Here to go to Home Page

Flowzr

Flowzr

is a simple budget and expense tracker website that manages your income

and expenses by analyzing your cash flow. You can create unlimited

accounts and add unlimited transactions with specific entities like

department, bank account, person, utilities, etc. Enter your

transactions offline and synchronize all your account information using

cloud services like Dropbox, and Google Drive. It allows fund transfers

between accounts, scheduled transactions, split transactions, and adds

recurring transactions or periodic transactions. You can generate and

view reports as flow charts, category reports, profit-loss reports,

forecast reports, and balance reports. The web-based application and

Android application is free to use. It also supports collaboration by

sharing account details but comes with a price of $1.99 per month.

Flowzr exhibits some excellent features, like:

- Save home currency and exchange rates.

- Add multiple budgets, projects, payees and locations.

- Wide range of categories and attributes.

- Reconciliation of bank accounts.

- Import/export QIF and CSV files.

Click Here to go to Home Page

Spending Profile

Spending Profile

is a free money management website that helps you keep track of your

expenses and monitor your budgets. It lets you create your own

categories and assign your transactions to them by specifying the

vendor. The overall breakdown of your finances is shown by graphs, which

represents your personal expenditures. Whenever you enter any

transaction, the summaries and graphs are instantly updated. It lets you

import transaction statements from your bank or credit card as OFX,

QFX, and QBB files. You can add income and expenses separately to view

the balance statistics. The cash flow of your expenses are displayed

using bar and line graphs. Some of the other features are:

- Plan and budget your finances.

- Control debt.

- View statistics as pie charts, bar graphs, and line graphs, and much more.

Click Here to go to Home Page

Xpenser

Xpenser is

a free online expense tracker with wide range of money management

tools. It has a unique feature i.e. voice tool that allows you to record

your expenses with your voice. It automatically transcribes your voice

recording and keeps the expense information. You can snap photos of your

receipts and send them via email to Xpenser. After that, Xpenser

handles your email receipts and extracts the expense information. You

can authorize Xpenser for gathering your bank statements to import,

categorize, and generate expense reports. It also lets you create

different projects to track expenses with entities like job, person,

department, etc. It offers different features, like:

- Record expense via email, voice, SMS, etc.

- Currency conversion.

- Send expense receipts as JPG, GIF, PNG, PDF, HTML, and TXT files, etc.

Click Here to go to Home Page

PettyCashBook

PettyCashBook

is a free money management website, which is used for managing small

amount of cash. It helps you effectively monitor receipts and expenses

and generate statistics in a single report. Using PettyCashBook, you can

know the remaining balances, expenditures, revenues, etc. for a

particular time period. Create unlimited companies (accounts) to manage

the accounting details and generate reports individually. Add cash

receipts for the companies with details like source of income, date,

description, etc. It lets you generate five different types of reports

such as closing balance, expense, group by, cash-in-hand, and cash

receipt reports. Closing balance reports gives you overall breakdown of

your credits, debits, and closing balances for a particular time period.

Groupby report assembles all the transactions for a particular item and

sums up for generating statistics of expenditures.

Click Here to go to Home Page

BIG4books

BIG4books is

a free online application that provides complete accounting solutions

for small money and small businesses. It comes with tons of accounting

tools such as financial statements, invoicing, credit, debit, ledger,

various reports, multi-user support, and much more. It uses SSL and TLS

encryption to protect and secure your account’s data and information.

You can create invoices and orders to track income and expenses

respectively. It provides you a flexible report generation platform

where you can generate your financial statements. You can import and

export transaction reports as CSV files. It comes with three different

plans:

Bronze:

- Customizable statements and HTML or PDF reports.

- Customer support (email/telephonic).

- Data storage and backups.

- Account admin and 1 non-admin user, etc.

Silver:

- User access control and user timeouts.

- No ads.

- Automatic data archive.

- Balance sheet, and much more.

Gold:

- 50 non-admin users.

- Unlimited inventory items.

- Unlimited vendor and customer records.

- Customizable accounts, etc.

Click Here to go to Home Page

Monzia

Monzia

is an online financial record keeping website that lets you send your

income and expenses via SMS, or apps (Web & Smartphone). It helps

you monitor and track your personal or business finances including

taxes. It provides you a default Monzia number absolutely free for

sending the records. When you send the income and expenses records to

Monzia number, it gets updated in real-time. Monzia provides you a free

report of income, expenses, and tax due for that particular month. You

can export your reports or statements as CSV, XLS, and PDF files. Its

Android mobile application gives you access to the Monzia dashboard on

the go. On the basis of reports and profits, it has different plans,

such as:

Free Plan:

- Total income reports.

- Total expense reports.

- Total profit or loss reports.

- Total tax due reports.

Paid Plans:

- Total breakdown reports.

- Mileage details and calculation.

- Sorting and search for transactions.

- Unlimited reports with memberships, etc.

Click Here to go to Home Page

HomeMoney

HomeMoney is

a free online money manager application that helps you analyze and

track your income, expenses, and budgets. Set financial goals and plan

budgets to optimize your expenses in order to save money. The web

application tools generally focus on controlling your budgets, and

expenses. It also offers different mobile apps with various features:

IPhone/iPad App:

- Add multiple transactions, transfers, income, and expenses.

- Review your income and expenses cash flow.

- Customize transactions, etc.

Android App:

- Import transactions from bank SMS’s.

- Save expenses, income, and transfers.

- Review and customize transactions, etc.

Windows App:

- Review transactions and account status.

- Enter transactions, income, and expenses.

- Customize accounts and transactions.

All

the apps have a unique feature, using which you can work offline and

automatically sync data when connected to network. HomeMoney offers free

and paid plans with distinct features and limitations.

Click Here to go to Home Page

CalendarBudget

CalendarBudget

is a free budget management website that helps for tracking expenses

and budgeting. The interface is like a calendar with income, expenses,

and balances of all your accounts. You can add multiple accounts and

switch between views for individual or overall accounts. It provides

financial reports for available balances, amount overspent, surpluses,

excess expenditure for budgeted categories, etc. The reports module

provides graphical representation of monthly spending or for a

particular time period. You can export the reports as CSV files or

create a PDF file of the calendar. It also lets you import and

manipulate transactions as OFX and QFX files. CalendarBudget allows you

to set reminders via email for budget plan updates, announcements,

upcoming, bills, etc. The other features are:

- Bookmark for returning to any date.

- Cloud-based platform.

- Track and forecast your finances.

- Reminders via email, and much more.

Click Here to go to Home Page

NeoBudget

NeoBudget

is a simple and easy to use online budget manager that helps you

setting up your budgets. It uses different images to represent an

envelope which displays your upcoming/paid bills, and savings. It lets

you create multiple budgets with virtual envelopes for interactive

management. You can download transactions from your bank and import them

to NeoBudget as QIF and OFX files. Create multiple accounts then create

envelopes to represent categories of your expenses. The free version

comes with limitations like 1 user, 1 account, and 10 envelopes which

can be overcome by upgrading to paid plan. It offers various features,

like:

- Debt worksheet.

- Supports split transactions.

- Budget calculator.

- Drag and drop organization.

- Automatically distribute income among different envelopes, etc.

Click Here to go to Home Page

MyUniverse

MyUniverse

lets you browse through credit card bills, loans, mutual funds, fixed

deposits, debit card expenses, etc. You can either connect your bank

account or enter transactions manually. It lets you add other entities

such as your assets, real estate, investments, etc. to the list for

monitoring. You can add bill payments and date to organize your bills or

pay your bills with simple transactions. Check and compare your net

worth, assets, liabilities, etc. and view your financial health.

MyUniverse lets you keep updated financial portfolio and track the

performance of your finances. It has tons of other features such as auto

categorizes transactions, mobile application, add personal investments,

etc. It offers free and paid plans:

Free Plan:

- 2 sites and 2 billers.

- Unlimited alerts and reminders.

- Money snapshot and auto update, and much more.

Paid Plans:

- Investment reports.

- Tax reports.

- Net worth reports, and much more.

Click Here to go to Home Page

BudgetTracker

BudgetTracker

is another free web-based application which helps you by managing your

personal budgets. You can create unlimited budgets with multiple

currencies and for different categories. You can either connect your

bank account or enter manual account information with different

categories. It allows you to import bank/credit card statements as OFX

and QFX files, and then specify the description and categories for each

transaction. It lets you create different charts and graphs to visualize

and analyze your finances. It lets you create short and long term

financial goals, in order to increase savings as well as to track your

progress over time. BudgetTracker is a complete online money management

tool that keeps track of all your accounts and transactions. It offers

features, like:

- Keep track of paychecks.

- Receive reminders for bill due, and much more.

Click Here to go to Home Page

BudgetEDGE

BudgetEDGE

is a free money management website that helps you create and manage

your budgets and finances. Enter income, expenses, and savings to view

your overall cash flow and remaining balances. The overall breakdown of

your finances is shown by graphs, which represents your personal

expenditures. It shows how much money you have left on a forward-looking

basis. Add transactions using file upload or manual entry and

categorize them with pre-defined categories or create your new category.

The categories included are income, utilities, insurance, groceries,

personal, etc. Manage your debts by knowing the exact movement of your

finances. Ultimately, BudgetEDGE gives you a platform for money

management which is interactive and easy to use.

Click Here to go to Home Page

22seven

22seven

is a free online money manager tool that helps you keep track of all

your finances in one place. Create a budget and personalize it with

different categories. You can link your bank accounts, credit cards,

loans, and investments or enter them manually. Enter income and expenses

to analyze and view your cash flow. All transactions are automatically

updated and sorted into different categories. It uses SSL encryption to

secure your accounts data. It lets you create bill reminders, categorize

budgets, tag budgets, organize loans, and much more. It also has

Android and iPhone apps for managing your money on the go.

Click Here to go to Home Page

1 comments :

Write commentsGreat Content with lots of useful information.It is useful for those who are looking for online expense tracker which helps you to track your business records and can check the overdue payments of client.

Reply